In summary, the EU passport holder is the Sponsor and all other Non-EEA/EU passport holders are dependants, regardless of previous financial status or who was the "breadwinner" or if the EU member was previously a home carer or unemployed, NOW ... the EU passport holder "Sponsors" the "Dependants."

Dependants does not only imply children, it applies to all the non-EU/EEA family members that EU/EEA member is able to bring to Ireland.

The order of residency stamps and renewals

The EU/EEA member needs to continue doing one of the 4 'routes' for their SA dependants to get each of these stamps

1) The Entry stamp is 90 days and is the period in which the EU/EEA member needs to do what's required and submit the paperwork for their dependants BEFORE this stamp date expires.

2) Temp Stamp or better termed Temp Stamp4EUFAM, approx. 6-12 weeks after application. (It is at this point that the Non-EU/EEA member can seek work as they have a residency stamp)

3) 5 Year IRP (Irish Residence permit) known as Stamp4EUFam at approx. 6-12 months after application

4) To get the extended residency permit, 6 months before the Stamp4EUFam expires at 5 years, at the point at which the SA passport holder can submit their Naturalisation documents to become an Irish Citizen.

4 Routes of the EU Treaty process

An EU/EEA member must be involved in one of the following 4 'routes' in order for their SA dependants to the these stamps

When filling out the EUTR1 or EUTR1A forms you will need to add evidence that the EU/EEA member is adhering to their obligations in this chosen route.

It is the actions of the EU Sponsor that matters throughout the residency stamp/permission processes (5 years).

The EU member needs choose their route from one of the 4 below, and the EU member needs to submit the paperwork for their dependants based on which you have chosen.

If you change route at any stage over the following 5 years, you inform EUtreaty division. They will advise what paperwork or proof you need to provide in order to be showing compliance.

1) Employed route

Just get out there and get a job, any job, full or part time. This job does not need to be on the Critical Skills list, it is not connected to the work permit requirements of SA passport holders at all. Similarly, the Ineligible list is also irrelevant to you. You can seek work once you are in Ireland within that first 90 day stamp, or you can organise a job before coming to Ireland. This is your choice or stroke of luck with finding work whilst still in SA and timing of your move. Even if you have work in the pipeline, or can prove you will be working soon, this will be ok to start the application, but for approval the EU member must be employed by an Irish registered company.

The EU/EEA can do any work at all.

Gather together your employment contract, 3 payslips and the other proofs and get your employer to sign off the EU form and submit your paperwork.

This employment must be in a legitimate Irish registered company and working within Ireland.

- This company must be registered with Revenue

- This company must be trading in Ireland and registered with the Companies Registration Office.

- You must be directly employed and paid by your employer in Ireland.

If you do not work for an Irish company registered in Ireland, you might want to consider opening your own business, registering that business and invoicing the company you work for as self-employed and pay your irish taxes that way, or work for an Umbrella company which is registered in Ireland, or ask the company if they are willing/able to open an Irish branch. If you are not employed or self-employed in Ireland paying taxes in Ireland you do not comply with the EU Treaty conditions unless you qualify under self-sufficient (see below).

2) Self Employed route

The EU/EEA needs to register your business as an Irish business on CRO.ie which ever type of company that is appropriate to the business. This is the official registration of an Irish company and you will need to show your Certificate of the Company's Registration Office.

It is a good idea to appoint an accountant to assist with your tax and have the accountant's contact information for the forms or you need to show your Letter of registration for self-assessment of income tax.

You will need to show 6 months of income and expenses are going through your business account as a legitimate Irish trading business declaring your income and expenses on the form.

- This company must be registered with Revenue

- This company must be trading in Ireland and registered with the Companies Registration Office

See below links to opening a business in Ireland and the mock-ups for the proofs needed for this kind of application

3) Study route

You need to prove:

- financial independence,

- private health care in Ireland

- that your course is an approved one (see links below for approved course list)

See links below to the Irish gov approved list of Study programs that qualify you for this kind of application

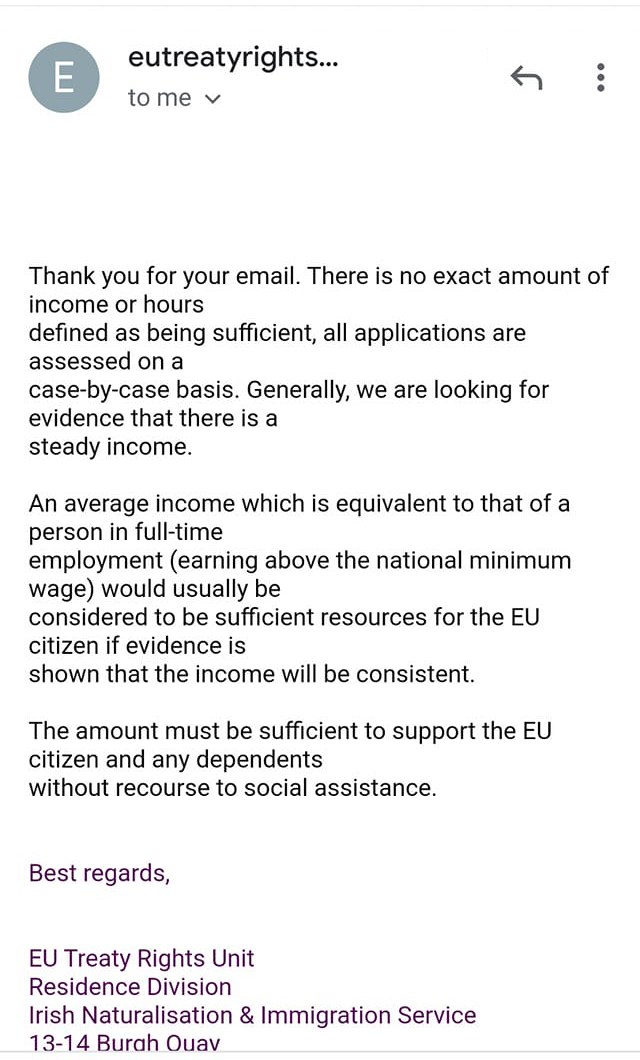

4) Self- Sufficient route

This route has a massive grey area: what amount of money is enough to prove the EU/EEA holder does not need to work?

Our recommendation is that on this route you need to consider that you are making a 5-year plan, sufficient funds needs to be thought of from the point of view that the EU/EEA Passport holder will not be working at all in 5 years of the residency stamp.

Consider this the "retirement" route of the EU Treaty where you have no intention of working as an employee in Ireland, or be self-employed or to study, you essentially have enough money coming in or that you have in a lump sum that for the next 5 years you won't be working.

There is no actual figure declared by the Irish Authorities. This route is reviewed on a case by case basis.

The EU/EEA holder has either:

- A large sum of money in savings available to cover your Irish expenses. This should be considered as the yearly minimum wage at least x 5 years

- or continuous sums of money from an external source that covers all costs in Ireland.

Examples of source of external sources of income- pension, stock/shares, 3rd party funds, investment dividends, some on-going income that proves that the income covers all expenses you and your dependants incur in living in Ireland.

- You need to provide proof you have not claimed anything from the state. There has been some mention if Child Benefit, which is a Universal State benefit to all children in Ireland, being a state benefit, should be excluded for self-sufficient or not, advice given to members who have used Irish Immigration Solicitors have been told not to take ANY benefits including child benefit as it could jeopardise the application now or in later years. Get legal advice before choosing to take this or any benefit.

- You need to provide evidence of this money, and should that money be coming from a person, evidence of your relationship to them.

- You also need to provide evidence of your monthly expenses in Ireland. This will include several months proof of all the bills you pay in Ireland and expenses you incur.

An example here would be a person living in Dublin likely to have much higher expenses than someone living rurally in a rural country cottage, hence, the figure of what the amount of money you have in lump sum, or the money you receive from an external source will be different based on location.

- You need to prove that, that money will cover all expenses with no support from the state.

- You also need private health care in Ireland for all members of the family

This route does not count towards state pension in later years, you also might have issues in regards to loans, morgages, some medical contributions etc as you are not employed nor paying taxes necessarily into the state.

Becoming an Irish Citizen

If the EU/EEA member continues to do what is required of them, for the full 5 years of their family members’ residency, they and their SA family may be eligible to Naturalise and acquire Irish Citizenship.

As the dependant of an EU citizen, you can apply to naturalise and then get your Irish citizenship after 5 years of living in Ireland subject to the Residency Calculator and proofs that are collected of co-habitation with the EU citizen in the Republic of Ireland.

See links below on Permanent residence and Naturalisation

Important links:

Our coaching Services - Confused or lost and need some direction, book a session with us to help untangle the confusion and work out your route of immigration

Our coaching Services - Confused or lost and need some direction, book a session with us to help untangle the confusion and work out your route of immigration

Employment - A few articles on CV writing, how to find work, getting employed and all things related to employment like, tax, pensions, USC, labour laws etc

Employment - A few articles on CV writing, how to find work, getting employed and all things related to employment like, tax, pensions, USC, labour laws etc

Download the EUTR1 form HERE - this will download as a .pdf to your downloads file

Download the EUTR1 form HERE - this will download as a .pdf to your downloads file

Download the EUTR1A form HERE - this will download as a .pdf to your downloads file

Download the EUTR1A form HERE - this will download as a .pdf to your downloads file

Approved list of study courses - If you go the Study route

Approved list of study courses - If you go the Study route

Family Dependants - IrishImmigration.ie

Family Dependants - IrishImmigration.ie

Private Medical Insurance in Ireland - If you go the Self-sufficient or Study route

Private Medical Insurance in Ireland - If you go the Self-sufficient or Study route

How the EU treaty process works:

Information on the process - A summary of the EU Treaty process

Information on the process - A summary of the EU Treaty process

4 routes of the EU Treaty - Choosing between the 4 types of the EU Treaty application: Employed, Self-emplyed, Self-Sufficient or Study

4 routes of the EU Treaty - Choosing between the 4 types of the EU Treaty application: Employed, Self-emplyed, Self-Sufficient or Study

For a deeper look at the Proofs needed for EU Treaty

For a deeper look at the Proofs needed for EU Treaty

For a deeper look at Dependants under the EU Treaty - Who qualifies as your dependant and what proof do you need?

For a deeper look at Dependants under the EU Treaty - Who qualifies as your dependant and what proof do you need?

Summary of the EU Directive (EU Treaty) - The EU law that covers this move and a print off for your travel for airlines and airport staff

Summary of the EU Directive (EU Treaty) - The EU law that covers this move and a print off for your travel for airlines and airport staff

Starting a Business in Ireland - For the EU member or their spouse/partner to go self-employed

Starting a Business in Ireland - For the EU member or their spouse/partner to go self-employed

How to do the paperwork for the EU treaty process:

Mock-up of the EUTR1 form- Qualifying Members - How to fill in the form

Mock-up of the EUTR1 form- Qualifying Members - How to fill in the form

Mock-up of the EUTR1A form- Permitted Members - How to fill in the form

Mock-up of the EUTR1A form- Permitted Members - How to fill in the form

What to do, when, on the EU Treaty Process

EU treaty step by step once you are in Ireland - A summary of the Steps as they play out from day1 to 5 years later

EU treaty step by step once you are in Ireland - A summary of the Steps as they play out from day1 to 5 years later

Register at Garda Immigration - How to register at Garda Immigration and Renewals of Residency stamps

Register at Garda Immigration - How to register at Garda Immigration and Renewals of Residency stamps

Special Dependancy Applications under the EU treaty process:

Bringing non EU parents with under EU Treaty - Specific information on who and what proof is required for an elderly relative

Bringing non EU parents with under EU Treaty - Specific information on who and what proof is required for an elderly relative

De Facto (unmarried) Partners and proofs required under EU Treaty - Paperwork needed to prove 2 year relationship and living together for non-married couples

De Facto (unmarried) Partners and proofs required under EU Treaty - Paperwork needed to prove 2 year relationship and living together for non-married couples

Change of Circumstances once you are in Ireland:

Change of Circumstances - The "what if" the relationship status or some changes with the EU member

Change of Circumstances - The "what if" the relationship status or some changes with the EU member

Permanent Residence and Naturalisation:

Permanent Residence and Naturalisation - How this works and how to prepare yourself from day 1 for five years time

Permanent Residence and Naturalisation - How this works and how to prepare yourself from day 1 for five years time

British Sponsor exercising EU Treaty rights in Ireland, Prior to Brexit.

Their Dependants fall under EU Treaty

British sponsor was Exercising EU treaty rights PRIOR to Brexit 31st Dec 2020

British sponsor was Exercising EU treaty rights PRIOR to Brexit 31st Dec 2020

Email on the Employed Route: